Northstar Mortgage is Changing to WATERSTONE MORTGAGE Corporation!

December 29, 2009

As we have seen many legislative changes in the mortgage industry, and are certain that more will be coming, we at the Ft. Walton Beach office of Northstar Mortgage Group have decided that it would be in the best interest of our clients and referral partners (Realtors®) if we were to become employees of a bank or employees of a mortgage company that is wholly owned by a bank. This would give us some advantages that we don’t currently have:

- Stronger Financial Backing/Access to more Capital (because we will be bank owned – the bank has over $2 billion in assets and the mortgage company will do over $750 million in volume for 2009)

- Lower Rates

- Better Technology

- Consistency in the Process for Each File

- Marketing Department/Full-time Graphic Artist on Staff

- Training

- Knowledge and Experience

- Faster Closings due to Quicker Underwriting Times

- Wider Variety of Loan Programs

After having talked to several companies and weighing the benefits of each, we have made the decision to become a part of WATERSTONE MORTGAGE CORPORATION, which is wholly-owned by Waterstone Bank of Pewaukee, Wisconsin! This change will become effective as of January 1, 2010. The transition will be made very easily because the only change that will be made as far as communicating with us will be our email addresses. We will remain at our same location in the office behind ECAR, our phone and fax number will remain the same, and we will still have the same employees giving you the same level of service (and probably even a higher level) that you have become accustomed to from us.

This change is being made to increase our ability to serve you and your clients and we think that you will find that it will do that and more! I have included the press release (below) from Waterstone about this change and know that you will find Waterstone Mortgage Corporation to be a greatly-needed change from the lenders you are currently using!

We are going to be having a presentation to the Real Estate Community, most likely in the afternoon of January 5 at the Kathy Building of ECAR. We are currently making the arrangements for this and will be sending details as soon as we have them. This meeting/presentation will be to show you how Waterstone does business and allow you to meet some of their regional management people from Winter Park, FL, as well to introduce you to some programs that you will find VERY exciting (for instance, most lenders, Northstar included, cannot lend at certain condominiums, ie: Tidewater and Destin West – Waterstone has a program that is based on the approveability of the CLIENT, not the project, and will allow us to do mortgages in those, and other buildings, that are not currently lendable!)

We will be contacting the Realtors® and borrowers on each and every one of the files we currently have in process to get their permission to transfer the file to Waterstone. Northstar Mortgage Corporation, LLC, will no longer be operating after the end of this year in any location as all offices are affiliating themselves with banks or bank-owned lenders.

Our current email addresses will not be accessible after Thursday, December 31; our new email addresses will be as follows:

Sue Botelho – sbotelho@waterstonemortgage.com

Mike Roche – mroche@waterstonemortgage.com

Laura Baldwin – lbaldwin@waterstonemortgage.com

Ed Kelley – ekelley@waterstonemortgage.com

However, we will not be able to access these email addresses until Monday, January 4, so we have created email addresses for you to use in the meantime:

Sue Botelho – SueWaterstone@gmail.com

Mike Roche – MikeWaterstone@gmail.com

Ed Kelley – EdWaterstone@gmail.com

Laura Baldwin – LauraWaterstone@gmail.com

Here are our cell numbers, as well, in case you need to get in touch with any of us from Thursday until Monday: Sue: 850-797-7946; Mike: 850-499-1623; Ed: 850-585-0880.

We want to wish you a Very Happy New Year and the hope that Waterstone Mortgage Corporation can help to make it a prosperous one! Again, following is the press release from Waterstone Mortgage Corporation.

WATERSTONE MORTGAGE CORPORATION

1133 QUAIL COURT

PEWAUKEE, WI 53072

******

For Immediate Release

******

Waterstone Mortgage Corporation Continues to Expand

Despite the recent industry decline, Waterstone Mortgage Corporation has continued to grow and gain market share. The Pewaukee, Wisconsin-based company is expanding with an office in Ft. Walton Beach, FL.

Waterstone Mortgage is a full-service residential mortgage banking firm that was recently named the 3rd largest among Milwaukee-area mortgage banking companies in 2008 by the Milwaukee Business Journal. Waterstone began operating as a residential mortgage lender in 2001. As of 2006, the company operates as a wholly-owned subsidiary of WaterStone Bank SSB, which is a unit of Waterstone Financial, Inc.

The Ft. Walton Beach office is located at 2 Park Circle, Suite A, Ft. Walton Beach, and has been managed by Sue Botelho and Mike Roche under the name Northstar Mortgage Group, LLC., for the last 3 years. The office, which will continue to be managed by Sue and Mike, and will continue as they have, still employing their Loan Processor, Laura Baldwin, and another Loan Officer, Ed Kelley. This office has expertise in all facets of mortgage financing, including Condotel, FHA, USDA and VA loans. The current employees of Northstar Mortgage Group’s Florida office will all now be employees of Waterstone Mortgage Corporation.

Waterstone is able to originate loans of all credit types for sale on the secondary markets. All functions from originating, processing, underwriting, closing, and funding are performed in-house by Waterstone employees. By becoming a Waterstone Mortgage Corporation office and effectively Waterstone Mortgage Corporation employees, Northstar Mortgage’s Florida office will enjoy more cost-effective operations by utilizing Waterstone’s administrative and processing support system. The stability created from the backing of WaterStone Bank offers the new office the ability to become involved in different investment opportunities that haven’t been previously available to them.

Expanding into different areas of the country is a benefit to Waterstone as well, by offering increased productivity and the opportunity to experience and utilize markets not currently available to Northstar Mortgage Group. Northstar Mortgage Group’s Florida office is a well-known and reputable mortgage lender, and Waterstone will enjoy the positive association with the Florida lender.

In attracting new offices, Waterstone traditionally considers contacts the company has made through previous business interactions. Quality people and businesses are the first considerations, followed by the locations of said businesses.

Waterstone Mortgage Corporation currently employs 293 people with offices located in Pewaukee, Madison, Lake Geneva, Delafield, Mequon, and Menomonee Falls, WI in addition to Florida, Idaho, Illinois and two Colorado offices.

The Stimulus Package

February 14, 2009

Today may be the day that the American Recovery and Reinvestment Act of 2009 (aka the Stimulus Package) is passed; the Senate is voting on it right now. It is anticipated that it will be on President Obama’s desk to sign into law this weekend. While we don’t have all of the information about this Act, here are some highlights:

Contains a record-setting $10.472 billion in funding for the USDA Guaranteed Rural Housing Program to insure Rural Housing mortgages. These funds are in addition to funds the program has already received through the Continuing Resolution, as well as additional funding expected from Fiscal Year 2009 Appropriations legislation or further Continuing Resolution legislation. Again: WE HAVE NEVER STOPPED CLOSING AND FUNDING USDA RURAL HOUSING LOANS AND WILL CONTINUE TO DO THEM EVEN WHILE OTHER LOCAL LENDERS HAVE STOPPED AND ARE TELLING YOU THEY ARE OUT OF MONEY! There was a rumor that the USDA guarantee fee was going up as part of the Stimulus Package; it will remain unchanged at 2.0% for purchase transactions. There was a tax credit increase requested by the Senate; it has since been scaled down to $8,000 (or 10% of the value of the home, which ever is lower) from $15,000, which is still $500 above where it currently is. This is for any first time homebuyers who purchase homes from the start of this year until the end of November. It starts phasing out for couples with incomes above $150,000 and single filers with incomes above $75,000. Buyers will have to repay the credit IF they sell their homes within three years.

More details will be provided to you concerning the impact of the Stimulus Plan once we go through the final version that is signed into law. Until that time, none of these are in effect yet.

USDA Rural Housing (100% Financing) Has Low Foreclosure Rate!

November 2, 2008

Evidence that the USDA Rural Housing program works to get qualified buyers into homes can be found by checking out their foreclosure website. Our office is in the Panhandle of Florida, and between here and Tallahassee (Leon) County, there are a total of 5 properties that are in foreclosure.

I have been using this program for over 10 years and based on the number of properties that have sold under it, this low number of foreclosures represents USDA’s committment to making sure that the buyers who use this program show an ability to repay the mortgage

A USDA Rural Housing loan allows a client to finance the entire sales price PLUS any and all closing costs and prepaids that the seller isn’t paying. A seller is not limited to 3% or 6% and can, in fact, pay all of the closing costs and the prepaids for the buyer. It truly is a no money down program for qualified buyers.

If a buyer’s credit and/or debt to income ratio doesn’t qualify for this program, there is a Direct USDA Rural Housing mortgage which allows lower income families to purchase a home at a payment that they can afford; sometimes, their payments are subsidized. If your lender tells you that you do not qualify, please ask them to give you the contact information for this program!

Choose the Right LOAN OFFICER, as well as the right Lender!

October 21, 2008

While it may be tempting to choose a loan officer and lender strictly based on the lowest-quoted interest rate, it is recommended that the decision be prioritized by a different standard – their reputation. As the loan officer to provide you with testimonials from past clients, as well as ancillary-related professionals (you can see mine here). Google your prospecitve loan officer’s name and see what type of information that they are contributing to help buyers and sellers and Realtors®. (It is suggested you google the first and last name of the loan officer, the word “mortgage” and the city and state in which their office is located – put this information all in quotation marks, ie: “Sue Botelho Mortgage Destin FL”) Ask local title companies of their experience in working with the loan officer – were the closing packages sent in time for the contractual closing date, was the package sent complete and correct, etc.

The process of finalizing a loan has many steps. A lot of paperwork must be drawn up, verified, processed, and signed by all of the parties within a relatively short time frame. Mistakes made by a loan officer can delay, and in sometimes completely end, the transaction completely. As a result, most Realtors® have horror stories about buyers that picked a loan officer and lender based only on their low-rate quote, only to have not only something in the transaction blow up, but the rate at closing to be higher than promised!

An irresponsible loan officer or lender can ruin your purchase. Keep yourself alert: start you loan officer/lender search by shopping reputation, not rates. Or course, rates and fees do matter – a lot! A good loan officer will let you know ahead of time what the current rates and fees are for their loan produces so you will know if they are fair and competitive. A GREAT loan officer will have a pulse on those markets that drive interest rate direction and choose to either lock or float their clients’ interest rate to assue that they get the benefit of the loan officer’s expertise and knowledge and that they get the lowest payment/rate available during the processing of the clients’ application.

In the end, having the right loan officer working for you can assure you that all of the details will be handled accurately and timely and that the clients are getting sound financial advise. Peace of mind is the number one priority!

Most of my posts are on the USDA Guaranteed Rural Housing Mortgage program. This is a mortgage program that gives 100% financing, including, if necessary, the funding fee, closing costs, and prepaids to enable a buyer to get in a house with absolutely no money down. This program is one in which the client goes to a mortgage lender (such as Northstar Mortgage Group!), a bank or a mortgage broker to get their financing. If a client makes less than a specified amount for a specific purchase area, and the property fits the geographical requirements, we can assist a buyer with financing.

However, what happens to those people who don’t make enough money to qualify for a home traditionally, whose income levels probably won’t qualify them for any house in the area based on traditional guidelines? Those that are between 50 and 80% of the area median income (AMI) are considered low income, or those that make less than 50% of the AMI are considered very low income. Most of the time, these buyers can’t qualify for a USDA Rural Housing Guranteed Mortgage. What happens to them?

Most lenders, bankers and brokers won’t tell you or your client this because they won’t get paid on it, but USDA has another program to help these people obtain homeownership. It’s the USDA Rural Housing Direct Loan program. These are directly funded by the Government and are available for low and very low income households. These loans are commonly referred to as Section 502 Direct Loans.

Recently, I have had two calls from prospective buyers who wanted to purchase a home; both of them fit the low to very low income guidelines of the USDA Direct program and I referred them to the USDA to apply for that program. One of them purchased a house and his total payment, including taxes and insurance, is $475. The other has a payment of $437!

USDA Direct loans are for terms up to 33 years (38 years for those with incomes below 60 percent of AMI and who can’t afford 33-year terms). The interest rate is based on the Government’s cost of money and is modified by payment assistance subsidies. Applicants must have reasonable credit histories and the housing must be modest in size, design and cost.

If you or someone you know is without adequate housing but would be able to pay monthly mortgage payments, contact either your local USDA office (there is typically one in each county) or you can contact me and I can point you in the right direction.

It’s not always about the income we get from originating mortgages; sometimes it’s about helping our fellow humans get the most basic of needs!

Florida FHA Loan Limits

October 15, 2008

| MSA Name | County Name | Single-Family |

| GAINESVILLE, FL (MSA) | ALACHUA | $204,440 |

| JACKSONVILLE, FL (MSA) | BAKER | $294,500 |

| PANAMA CITY-LYNN HAVEN, FL (MSA) | BAY | $251,750 |

| NON-METRO | BRADFORD | $200,160 |

| PALM BAY-MELBOURNE-TITUSVILLE, FL (MSA) | BREVARD | $221,350 |

| FORT LAUDERDALE-POMPANO BEACH-DEERFIELD BEACH, FL | BROWARD | $362,790 |

| NON-METRO | CALHOUN | $200,160 |

| PUNTA GORDA, FL (MSA) | CHARLOTTE | $224,209 |

| HOMOSASSA SPRINGS, FL (MICRO) | CITRUS | $200,160 |

| JACKSONVILLE, FL (MSA) | CLAY | $294,500 |

| NAPLES-MARCO ISLAND, FL (MSA) | COLLIER | $362,790 |

| LAKE CITY, FL (MICRO) | COLUMBIA | $200,160 |

| ARCADIA, FL (MICRO) | DE SOTO | $200,160 |

| NON-METRO | DIXIE | $200,160 |

| JACKSONVILLE, FL (MSA) | DUVAL | $294,500 |

| PENSACOLA-FERRY PASS-BRENT, FL (MSA) | ESCAMBIA | $200,160 |

| PALM COAST, FL (MICRO) | FLAGLER | $218,500 |

| NON-METRO | FRANKLIN | $200,160 |

| TALLAHASSEE, FL (MSA) | GADSDEN | $200,160 |

| GAINESVILLE, FL (MSA) | GILCHRIST | $204,440 |

| NON-METRO | GLADES | $200,160 |

| NON-METRO | GULF | $200,160 |

| NON-METRO | HAMILTON | $200,160 |

| WAUCHULA, FL (MICRO) | HARDEE | $200,160 |

| CLEWISTON, FL (MICRO) | HENDRY | $200,160 |

| TAMPA-ST. PETERSBURG-CLEARWATER, FL (MSA) | HERNANDO | $222,300 |

| SEBRING, FL (MICRO) | HIGHLANDS | $200,160 |

| TAMPA-ST. PETERSBURG-CLEARWATER, FL (MSA) | HILLSBOROUGH | $222,300 |

| NON-METRO | HOLMES | $200,160 |

| SEBASTIAN-VERO BEACH, FL (MSA) | INDIAN RIVER | $213,750 |

| NON-METRO | JACKSON | $200,160 |

| TALLAHASSEE, FL (MSA) | JEFFERSON | $200,160 |

| NON-METRO | LAFAYETTE | $200,160 |

| ORLANDO-KISSIMMEE, FL (MSA) | LAKE | $268,850 |

| CAPE CORAL-FORT MYERS, FL (MSA) | LEE | $270,750 |

| TALLAHASSEE, FL (MSA) | LEON | $200,160 |

| NON-METRO | LEVY | $200,160 |

| NON-METRO | LIBERTY | $200,160 |

| NON-METRO | MADISON | $200,160 |

| SARASOTA-BRADENTON-VENICE, FL (MSA) | MANATEE | $336,100 |

| OCALA, FL (MSA) | MARION | $200,160 |

| PORT ST. LUCIE-FORT PIERCE, FL (MSA) | MARTIN | $276,640 |

| MIAMI-MIAMI BEACH-KENDALL, FL METROPOLITAN DIVISIO | MIAMI-DADE | $362,790 |

| KEY WEST-MARATHON, FL (MICRO) | MONROE | $362,790 |

| JACKSONVILLE, FL (MSA) | NASSAU | $294,500 |

| FORT WALTON BEACH-CRESTVIEW-DESTIN, FL (MSA) | OKALOOSA | $237,405 |

| OKEECHOBEE, FL (MICRO) | OKEECHOBEE | $200,160 |

| ORLANDO-KISSIMMEE, FL (MSA) | ORANGE | $268,850 |

| ORLANDO-KISSIMMEE, FL (MSA) | OSCEOLA | $268,850 |

| WEST PALM BEACH-BOCA RATON-BOYNTON BEACH, FL METRO | PALM BEACH | $362,790 |

USDA Rural Housing Mortgage Loan Pro!

October 6, 2008

My title on ActiveRain says that I am a “USDA Rural Housing Mortgage Loan Pro”. I am licensed to originate USDA loans in Florida, Alabama, Georgia, Tennessee, and the Carolinas.

The media tells you that 100% financing does not exist today for your buyers today. This is not true. Of course 100% financing is available to Veterans but it is also available through the USDA via their Rural Housing program.

If you are going to place your commission check in the hands of a loan officer where your client needs 100% financing, send them to an expert. When LoanToolbox, a company that educates over 10,000 mortgage professionals across the country, wanted to educate their membership on benefits of the USDA, they sought out an expert to help them. That expert was me, Sue Botelho.

Not only did LoanToolbox interview me for the benefit of their members, they also requested sales presentation materials I use when educating the real estate community, including the PowerPoint presentation you may have already seen. (If you see someone else present something similar, plagiarism is the greatest form of flattery!)

Bottom Line. If you had to place your commission check in the hands of the student or the teacher, who would you choose? When the mortgage industry seeks expert advice, they sought out Sue Botelho. When you have clients needing expert advice and your commissions are at risk, who will you seek out? Call me, I will get your deal done and get you paid. I get deals done others can not.

Read below where you can see Loan Toolbox turned to me for information I can provide you every day.

New USDA Presentation and Marketing Kit

What if there was a loan product available that offered 100% financing to your buyers – and they don’t have to be veterans to qualify? What if rates for this product were not only attractive, but it also didn’t require monthly mortgage insurance? And finally, what if this same loan didn’t require any additional licensing on your part to originate?

Does this sound like something your clients and REALTORS® would like to know about?

Listen to today’s business tip from LTB faculty member Jim Sahnger and learn how USDA loans – that’s right, the US Department of Agriculture – can help you close more deals and put even more in your pipeline. More importantly, listen as Jim announces a new USDA Marketing Kit LTB will release this week with everything you need to take advantage of this great opportunity, including a new conference call with Jim and LTB member Sue Botelho and MBP speaker Linda Davidson, a new PowerPoint presentation, and all the necessary handouts.

To learn more about this incredible opportunity, listen to today’s voice broadcast..

How To Reduce Your Mortgage!

September 19, 2008

There’s a simple trick to significantly reduce the length of your mortgage and save you thousands of dollars. The trick is to make one extra mortgage payment a year and apply that payment toward your loan’s principal.

This is the method being used by “Bi-Weekly Mortgage Reduction Services” and “Bi-Weekly Mortgage Savings Programs”. Only, when you do it yourself, you don’t pay a third party unnecessary set-up costs and fees!

Example: $100,000 loan, 30-year mortgage, 6.5% fixed interest rate

|

One-time Payment

It may not be possible for you to increase your monthly mortgage payment. Keep in mind that most mortgages will permit you to make additional payments to your principal at anytime. Perhaps, five-years after moving into your home you receive a larger than expected tax return, or an inheritance or a non-taxable cash gift. You could apply this money toward your loan’s principal, resulting in significant savings and a shorter loan period.

Example:

With a $100,000, 30-year, 6.5% fixed interest rate mortgage loan, the borrower will pay a total of $227,542.98 to pay back the loan in 30 years. That equals $127,542.98 in interest payments.

If the same borrower makes a one-time $5,000 payment the first day of year 6, he/she will pay a total of $204,710.75 and pay off the loan in 27 years (324 months). That’s a savings of $22,832.23 in interest.

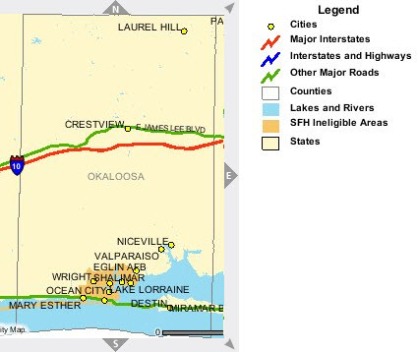

USDA Rural Housing Loan (Mortgage) Property and Income Eligibility – Okaloosa County, FL

September 16, 2008

The map above shows those areas in Okaloosa County, FL that are eligible for USDA Rural Housing loans. Basically, the only areas that aren’t eligible are “between the bases” – Ft. Walton Beach, Shalimar, and Mary Esther east of Hurlburt Field. Following is the income guidelines used to determine if a buyer would qualify for a USDA Rural Housing loan based on the number of people in their family. Please note that there are some deductions from a buyer’s income that may help those who are over these guidelines to qualify, ie: medical expenses for disabled family members, a credit for full-time students, a credit for those in the household under 18 years of age, child care expense credit, etc. If you aren’t sure if you or your client are eligible, please call me at 850-424-6866 or email me.

Income Limits for Guaranteed Rural Housing Loan based on number of people in household:

1 Person: $50,850

2 Person: $58,100

3 Person: $65,400

4 Person: $72,650

5 Person: $78,450

6 Person: $84,250

7 Person: $90,100

8 Person: $95,900

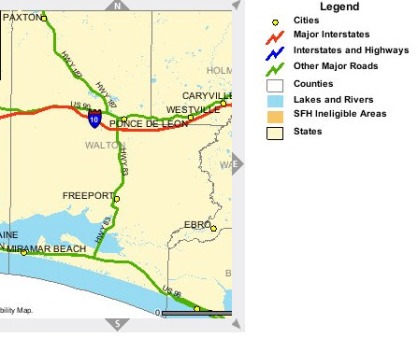

USDA Rural Housing Loan (Mortgage) Property and Income Eligibility in Walton County, FL

September 16, 2008

The map above shows those areas in Walton County, FL that are eligible for USDA Rural Housing loans. Basically, the entire county is eligible! Under the map is the income guidelines used to determine if a buyer would qualify for a USDA Rural Housing loan based on the number of people in their family. Please note that there are some deductions from a buyer’s income that may help those who are over these guidelines to qualify, ie: medical expenses for disabled family members, a credit for full-time students, a credit for those in the household under 18 years of age, child care expense credit, etc. If you aren’t sure if you or your client are eligible, please call me at 850-424-6866 or email me.

Income Limits for Walton County, FL based on number of people in household:

1 person: $49,550

2 person: $56,600

3 person: $63,700

4 person: $70,750

5 person: $76,400

6 person: $82,050

7 person: $87,750

8 person: $93,400